Stay In Your Seat

For the second time in two years, we’re in bear territory again. Bear market territory that is, defined as a 20% or more drop in major market indices. Using the Vanguard Total Stock Market Index ETF (VTI) as a representative benchmark, US stocks are down 19% year-to-date as of this writing (6/25/22).[1]

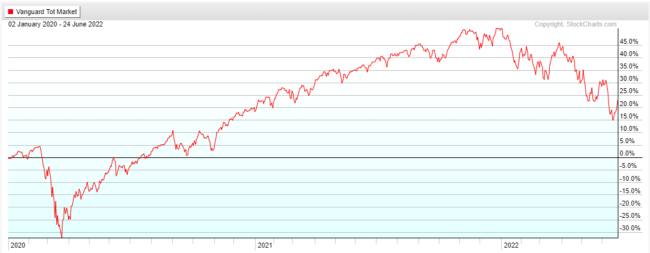

That’s painful, but for perspective, year-to-date the stock market is up a cumulative 81% since 3/23/2020, the bottom of the COVID crash. As shown below, since the end of 2019, before COVID, the market is up a cumulative 24%. The latter is in keeping with long-term stock returns – I’d take that all day long!

Of course, the pain may not be over. Two years ago, the federal government and the Federal Reserve (“Fed”) pulled out all the fiscal and monetary stops to avert a potentially severe recession from the pandemic. The market responded remarkably fast, rebounding an amazing 122% from the 3/23/2020 low through the end of last year.

But the extraordinary economic stimulus, combined with pandemic-induced supply constraints and Russia’s invasion of Ukraine, has ignited inflation at a level not seen in decades. This prompted the Fed to reverse course and aggressively raise interest rates. Investors now fear we may careen from recovery to recession, driving the market down. Barring a rapid decline in inflation, a quick market rebound seems unlikely this time around.

Nevertheless, my guidance to clients and most investors is the same as it was in March 2020: Stick to the plan!

To reap the long-term higher returns from stocks (that most of us count on to meet our goals), we must endure times like these. Sporadic, temporary market declines are an inevitable part of investing.

Some are strongly tempted to avoid further pain by selling and moving to cash. Call it what you want, selling now would be a form of market timing, an effort to improve investment results by getting in and out of the market at opportune times. To succeed it requires both prescience – the ability to forecast the future – and precise timing. Not just once, but twice: When to get out, and when to get back in. In my view (and that of many others), there is no effective way to do this short of pure dumb luck.

You may think that, ok, maybe I won’t get the timing perfect, but I can protect my portfolio from further losses now and get back in when “things look better.” How will you gauge that? If you wait until after several days of positive market returns, you may have missed the turnaround and done irreparable damage to your portfolio’s long-term performance.

The impact of missing just a few good days in the market is powerfully demonstrated in the following one-minute video from Dimensional Funds. As you watch keep in mind the data are based on a 31-year period from 1990 to 2020, representing approximately 7,800 trading days.

Still want to try to time the market? I don’t know much about gambling[2], but market-timing seems like a really long odds bet to me!

My wife and I just returned from an overseas group trip. International travel is a fantastic experience, but you must endure the hardships of air travel: early mornings, crowded terminals, security checks, delays, and long flights in cramped conditions. Flight attendants constantly remind you to stay safely buckled in your seats. Investing is a lot like air travel: To safely reach our destination, we must stay in our seats, especially when the ride gets bumpy!