The Way to Wealth Part 2: Many Happy Returns!

An investment in knowledge pays the best interest.

—Poor Richard (Benjamin Franklin)

I designed the following illustration from my previous “Way to Wealth”[1] post to inspire the younger set to start saving early and often for retirement and other goals:

- Assume your goal is $1,000,000 in today’s dollars by age 65. Assuming a 6% “real” return (after inflation), you’d need to save about $1,000 in today’s dollars each month starting at age 35. But if you start at 25 instead, the amount you need to save drops by 50% – $500 per month!

My intent was to highlight the powerful impact of how long you save on the amount you need to save. Nevertheless, one observant younger reader emailed me about the third variable, rate of return, questioning the plausibility of my 6% real return assumption considering recent historically low interest rates.

People generally understand that more is better when it comes to any of the three wealth-building levers. Raising the first two – time saved and amount saved – is pretty black and white: Start now and save as much as you can! (Simple, but not always easy or, for some, even possible.)

Less clear is how to get more rate of return. That’s my theme for this post and a pillar of investment theory: Getting higher returns requires taking on more risk[2].

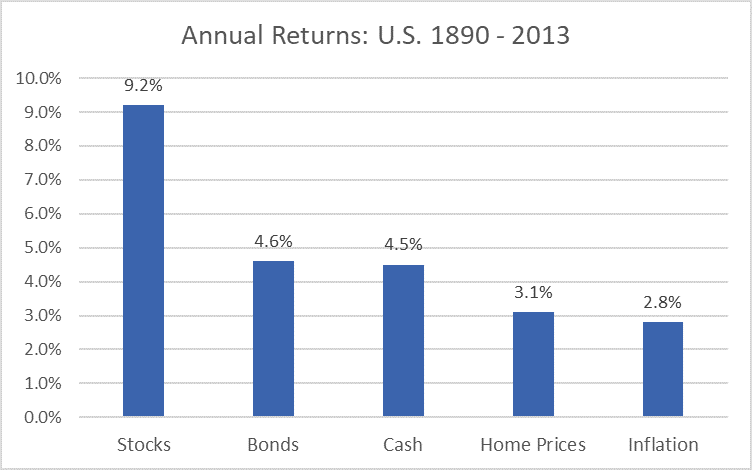

I often use the following chart to illustrate this concept with clients. It shows the annual rate of return on several key asset “classes” (U.S. stocks, bonds, cash and home prices) going all the way back to 1890.[3]

Stocks clearly have provided the biggest bang for the buck over the long term, handily beating inflation as well as the other main asset classes. (Note that stocks’ after-inflation return for the period was 9.2% – 2.8% = 6.4%, in line with my assumed return in the above illustration.)

Why is the return from stocks so much higher? Fundamentally, it’s the difference between being an owner vs. a lender. When you buy stock, you own a share of the assets and earnings of a business, paid out to you as dividends and/or growth in the value of your investment if the business is successful and grows its earnings.

In contrast, when you deposit cash in savings or buy bonds you’re merely lending money, generally at a fixed interest rate with limited to no opportunity for growth in your principal.

But the payoff from being an owner is generally less certain than being a lender, and the riskier the payoff is perceived to be, the less investors will be willing to pay to buy in. By paying less investors raise the odds that their return will be higher than from less risky investments. Behold the risk-reward pricing mechanism![4]

Say we want to make a major purchase next year. If we invest the money in stocks, we almost certainly won’t get the 9.2% return shown above when we cash in. It could be more, it could be less – possibly even negative. No one really knows, despite what you may read or hear from media pundits.

Investment professionals refer to this unpredictability as investment risk. It’s why many advisors (including me) advise against investing money you’ll need in the short term (e.g. less than 5 years) in stocks.

Risk means more things can happen than will happen.

—Elroy Dimson, London Business School, expert on long-term stock returns and co-author, “Triumph of the Optimists”

Helping people understand and manage the “risk-return trade-off” is a critical part of what planners do. Here’s my approach:

1. Balance the need for higher returns with your tolerance and capacity for risk.

Risk tolerance is our ability to hang in there when the ride from volatile investments gets rough.

Getting back to the three wealth-building factors, some folks try to make up for less time and savings by “reaching for return” in higher-risk investments. But this can backfire if the “downs” are more than they can stomach, causing them to panic and sell, thereby missing out on the subsequent “ups.”

Remember the last stock market crash that bottomed in March 2009? Investors that bailed and kept waiting for things to “look better” missed out on the subsequent near quadrupling of the S&P 500!

Risk capacity reflects our need to take on risk, generally a function of our investing horizon (i.e. our age), and how well-funded our goals are (how much you have saved already and/or availability of other funding sources like pensions).

2. Focus on the “right” risks. We can take on more risk without materially improving our odds for higher returns. Prime example: Investing in the latest “hot stock” tip. Sure, we might get lucky and pick the next Apple, but this takes us into the realm of speculation (yea, gambling!), not investing.

Prevailing investment theory holds that we aren’t adequately compensated for the unique risks of investing in individual companies/securities because those risks can easily be avoided through diversification. Diversification is the proverbial “not putting all your eggs in one basket” achieved by spreading investments across multiple companies and investment types.

Smart investors take on only the risks they must – those unavoidable uncertainties that impact all investments, like inflation, interest rates, investor panic and others.

Here’s my simple formula for maximizing your odds of investing success, gleaned from experience, Nobel Laureates and famously successful investors (e.g. Warren Buffett and others):

1. Get in the game! While some investors take on more risk than they can handle, others take on too little. You can avoid investment risk by not investing in stocks, but you then expose yourself to other risks, like the relentlessly wealth-corroding impact of inflation, or “longevity risk” – the possibility of outliving your savings. (Never forget there is no riskless investment!) Used judiciously, stocks offer the best odds of building long-term wealth and reaching your goals.

2. Decide how much of your portfolio to allocate to stocks. The mix of stocks vs. bonds and cash is the main driver of portfolio returns and volatility.

3. Keep diversification high and costs low when implementing your plan. Broadly-diversified index funds and ETFs are a great place to start. (Don’t forget taxes are the highest cost most investors face – invest in a tax-savvy way!)

4. Stick to the plan through thick and thin! Ignore the news and pundits and revise the plan only if your personal circumstances have changed. Review your portfolio annually and reset the asset mix when the varying ups and downs of the portfolio components cause them to stray appreciably from the plan proportions (aka “rebalancing”). Maintaining this discipline is another area a planner can help with.

I support and applaud those who wish to invest the time and study to do this themselves – that’s how I got started. I’m happy to consult on an as-needed basis for those who wish to go the do-it-yourselfer route but want someone looking over their shoulder for a second opinion (and possibly talk them off the ledge when things get scary, as they inevitably will!).

But for many, the prospect of having to wade into all this evokes reactions bordering on the allergic. (That’s me when it comes to home improvement projects! Results are faster, better and way less painful if I let a professional do the job.) For these folks I offer a one-stop solution to relieve them of the time and emotional burden associated with these tasks.

Whichever path you choose, I’ll end this second installment of my Way to Wealth series with the same exhortation as the first: Start today!

[1] The titles of both posts are a nod to Benjamin Franklin’s essay “The Way to Wealth,” a collection of wise sayings from Poor Richard’s Almanac. Check it out – you will be struck by the timelessness of Franklin’s advice.

[2] Beware those who say otherwise – you’re almost assuredly not getting the full story. Remember Bernie Madoff’s epic Ponzi scheme that cost his clients billions? When asked about his unprecedented ability to deliver 10% returns year after year, he simply replied: “It’s a proprietary strategy. I can’t go into it in great detail.” And people – including many “professionals” who should’ve known better – bought it!

[3] Calculated from data courtesy of Robert Shiller of Yale: http://www.econ.yale.edu/~shiller/data.htm. Dr. Shiller is the Nobel-prize-winning author of the investing classic “Irrational Exuberance” and renowned for predicting both the 2000 internet and 2008 real estate bubbles (and subsequent crashes).

[4] Price and value are inherently subjective. As we’ve learned from the emerging field of behavioral finance, prices are continually negotiated by buyers and sellers based on their respective views of the future, colored by varying degrees of rationality. So the value estimates (prices) generated by “the market” (the forum where buyers and sellers come together to negotiate) may not always be rational, but they’re hard to beat, especially for the long run. As Benjamin Graham, the father of value investing (and Warren Buffet’s graduate school professor and mentor) put it: “In the short run, the market is a voting machine, but in the long run it is a weighing machine.”